Interest capitalization is one of the basic market mechanisms. It consists in the fact that the interest on the loan is charged not only on the amount of the loan, but also on the interest previously charged. As a result, the borrower pays more and more installments, and the loan becomes more and more difficult to repay. The capitalization of interest is particularly disadvantageous for borrowers who have trouble repaying the loan. Therefore, it is always a good idea to read the loan contract carefully and make sure that interest capitalization is included in it.

What exactly is interest capitalization? Definition of the term

Interest capitalization period

The interest capitalization period, otherwise known as the capitalization period, is the time during which banks recalculate their interest rate for future payments. This means that the longer the interest capitalization period, the higher your monthly installment. The interest capitalization period is especially important for those who plan to take out a mortgage. It is worth knowing that a long capitalization period may be attractive to the bank, but not necessarily to the customer. Therefore, before signing the contract, it is worth thinking carefully about your decision and consulting specialists.

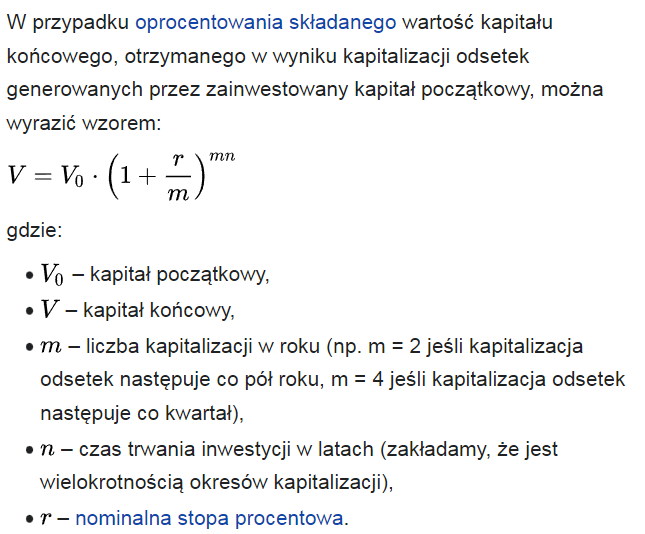

How to calculate the capitalization of interest? Formula

Capitalization of interest – why is it important?

The term capitalization of interest is often used in banking, and it means converting interest into principal. Why is this important? Because it means that we will have more money at our disposal in the future. This is especially important for long-term investments, such as bank deposits or mortgages. It is worth remembering that the longer the capitalization period, the greater the amount available.